south dakota property tax rate

South Dakota also does not have a corporate income tax. The state of South Dakota has a relatively simple property tax system.

How Are Property Taxes Calculated Plains Commerce Bank

The portal offers a tool that explains how local property.

. This portal provides an overview of the property tax system in South Dakota. Custer County has one of the highest median property taxes in the United States and is ranked 729th of the 3143 counties in order of median property taxes. Contents1 Is South Dakota a tax friendly.

Percentage of Home Value A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities.

If the county is at 100 of full and true value then the equalization. 128 of home value Tax amount varies by county The median property tax in South Dakota is 162000 per year for a. South Dakota Property Tax Rates.

Then the property is equalized to 85 for property tax purposes. State Summary Tax Assessors South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Across the state the average effective property tax rate is 122.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and. What Rates may Municipalities Impose.

You can look up your recent. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. The South Dakota sales tax and use tax rates are 45.

This is the value upon which your South Dakota property taxes are based. Then the property is equalized to 85 for property tax purposes. The median property tax in Minnehaha County South Dakota is 2062 per year for a home worth the median value of 144900.

Across South Dakota the average effective property tax rate is 122. If you have questions regarding your federal tax return W-2 or stimulus checks please contact the. The median property tax in Stanley County South Dakota is 1244 per year for a home worth the median value of 113700.

All property is to be assessed at full and true value. Custer County collects on average 097 of a propertys assessed fair market value as property tax. South Dakota Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused on your property bill.

South Dakota Property Taxes Go To Different State 162000 Avg. Lincoln County has the highest property tax rate in the state at 136. The median property tax in Custer County South Dakota is 1554 per year for a home worth the median value of 160700.

Welcome to the South Dakota Property Tax Portal. For instance if your home has a full and true value of 250000 the taxable value will add up to 250000. The average yearly property tax paid by Stanley County residents amounts to about 208 of their yearly income.

The state of South Dakota has a relatively simple property tax systemAcross the state the average effective property tax rate is 122. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. If the land does not meet the acreage.

Tax rates set by local government bodies such as municipalities and school districts are applied to the full market. Stanley County collects on average 109 of a propertys assessed fair market value as property tax. The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

A countys acreage requirement can range from 20 acres to 160 acres. Income Tax South Dakota is one of seven states that does not impose a state income tax. The land must also meet either an acreage requirement or a minimum income.

Homeowners living in a primary residence in South Dakota are eligible for a tax rate reduction. This surpasses both the national average of 107 and the average in North Dakota which is 099. Minnehaha County collects on average 142 of a propertys.

2 4 Tax Increase On The Way For Sioux Falls Property Owners

South Dakota Income Tax Brackets 2020

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

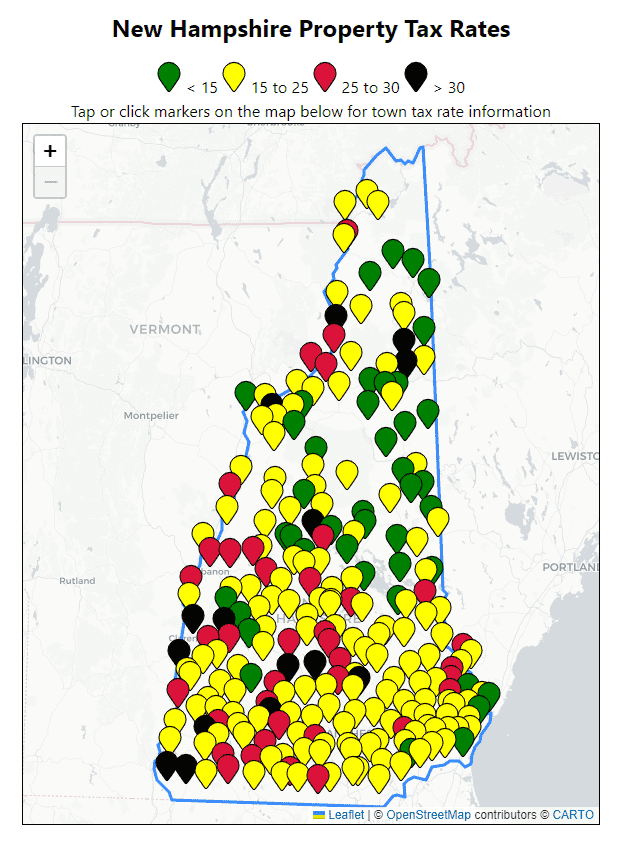

All Current New Hampshire Property Tax Rates And Estimated Home Values

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

10 Best States For Lowest Taxes Moneygeek Com

South Dakota And Sd Income State Tax Return Information

Property Taxes By State In 2022 A Complete Rundown

Property Tax Calculator Estimator For Real Estate And Homes

Property Tax South Dakota Department Of Revenue

Property Tax Calculator Estimator For Real Estate And Homes

South Dakota Taxes Business Costs South Dakota

States With No Income Tax Explained Dakotapost

Property Tax South Dakota Department Of Revenue

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Map Of Rhode Island Property Tax Rates For All Towns

Are There Any States With No Property Tax In 2022 Free Investor Guide

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities